Bookkeeping is the recording of all financial transactions for a business. Keeping good financial records (“books”) is an essential part of business management and a requirement for success. Good financial records will provide you with information to make sound business decisions and are necessary to obtaining financing and to prepare your taxes.

There are a number of accounting/bookkeeping software programs available on the market to help ease the tediousness of tracking your financial information. Whenever possible we recommend using an accounting software program as it eliminates many of the manual processes described in this section and (provided you are inputting the information on a regular basis) can give you quicker access to financial date to help manage your business.

Some widely used software packages include:

Each has their own advantages and disadvantages so be sure to talk to your accountant or business resource when choosing the software that works for you. Most offer a free trial to let you check out the program.

Not everyone will be comfortable using an accounting software program. However, you can’t successfully manage your business without some sort of an accounting system. This section describes the basic components of building a manual system should you choose this route.

Why is this important?

You need accurate records of your transactions to monitor the progress of your farming business – to determine whether your business is improving, which crops are selling, and what changes you could/should make. You need records to prepare accurate financial statements for grants and loans and to manage your business. You can maximize your tax savings by identifying non-taxable income and tracking deductible expenses. Good records allow you or your tax preparer to easily prepare your tax return, saving your business time and/or money.

Basic system components

A basic manual bookkeeping system should include the following:

Sales Receipt Book – Book of receipts, each with a unique number, with carbon-copy duplicates for filing, which are used for evidence of sales and for capturing information for the Monthly Income Record.

Fill this out each time you make a sale; give the original to the customer.

Sales Receipt Book

Checking Account – Bank checking account that is used only for your business transactions, with a checkbook that generates carbon copies. Use this account to pay vendors who don’t accept cash or credit cards, help manage your cash flow, assist in tracking business expenses, as evidence of payment, and to capture information for the Monthly Expense Record.

Pay for business expenses using the checks from this account. Don’t pay for non-business items using this account. Also, consider getting a business credit card separate from your personal credit card to use for business related purchases.

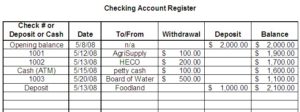

Checking Account Register – Log sheet that records all transactions for the checking account and maintains the expected bank balance. The register is used to track available bank balance and when reconciling against the bank’s monthly statement.

Record all checks written and other account transactions (e.g., ATM withdrawals, deposits) in this log and update the running balance.

Expense Filing Folder – Durable 12-pocket accordion folder, with each pocket labeled with the months of the year. The folder is used to track business expenses, as evidence of payment, and to capture information for the Monthly Expense Record.

Place all receipts for business purchases into the corresponding month pocket.

Expense Filing Folder

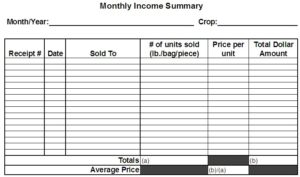

Monthly Income Record – Log sheet to record sales information for the month, with each crop/product/service receiving a separate sheet. This record provides (at-a-glance) a recap of total sales per product and who it was sold to, and captures information for the Annual Income Summary.

Transfer information from the Sales Receipt Book and record any sales for which you do not use the Sales Receipt Book for the month. Different products go on different sheets.

Monthly Expense Record – Log sheet to record expenses for the month, categorized by expense type. This record provides a recap (at-a-glance) of expenses per category, and captures information for the Annual Expense Summary.

Record information from the Expense Filing Folder for the month, along with the checks written in the month and any other business expenses paid with cash or credit card. Write down the amounts for each item or service purchased in the correct category.

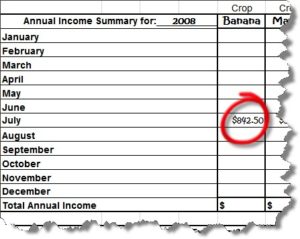

Monthly expenseAnnual Summaries of Income and Expenses – Log sheets to record income (sales) and expenses for the year, categorized by crop and expense category, which give you an “at-a-glance” recap of all farm income and expenses throughout the year and to determine net profit/loss.

Transfer totals from the Monthly Income and Expense Records to the corresponding fields on these tables. For the Annual Income Summary, total the entries by month and then by crop/product/service. For the Annual Expense Summary, total the entries by month and then by category.

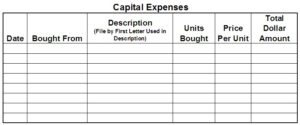

Annual Income Annual ExpenseCapital Expense Record – Log sheet to record equipment purchased for the business that are depreciable on your tax returns, used in preparing your tax returns to calculate depreciation, amortization or depletion deduction and to determine your basis for computing gain (or loss) when you sell or otherwise dispose of the equipment. You will maintain this record for as long as there are items on the list that you are still depreciating, amortizing, or depleting.

Record any purchases of items that cost more than $500 and that you expect to use in more than one tax year.

Folders for Other Records – Six-pocket accordion folder, used to organize documents, with the following sections (labeled):

- Bank Account Statements

- Equipment and Capital Expense Records

- Loan and Credit Card Statements

- Payroll Taxes (Federal and State)

- General Excise Taxes

- Income Taxes (Federal and State)

File copies of related documents in each section as you receive or generate them. Order the items chronologically, with the newest documents toward the front of each pocket.

Daily record keeping activities

Every day:

- As you make sales, record each sale in your Sales Receipt Book. If you make a sale that does not use the Sales Receipt Book (e.g., mail order sale over the internet), enter the sale information in the Monthly Income Record.

- As you purchase items, save the receipt in the proper month’s pocket of the Expense Filing Folder. If you make a purchase that does not produce a receipt or use the checkbook, write down the following information on a sheet of paper:

- Date

- Vendor

- Total amount

- Description of item(s) with amount of each item (if they would fall under two or more expense categories)

- Method used to pay (e.g., cash)

File the sheet in the Expense Filing Folder.

- Any transaction that impacts your checking account should be recorded in the Checking Account Register, and the balance updated.

- If you purchase a capital expense item, record it in the Capital Expense Record and save the receipt in the Other Records Folder.

- File copies of any relevant papers you receive and things you create in their respective pockets of the Other Records Folder.

Monthly activities

At the end of every month (or more frequently):

Transfer Sales

- Transfer all the sales information from your Sales Receipt Book to a new Monthly Income Record for the month/crop, and total the number of units sold and dollar amounts. If you want to calculate your average price per unit, divide the total number of units by the total dollar amount.

Transfer Expenses

- Transfer all expense information from your Expense Filing Folder and checking account register to a new Monthly Expense Record for the month. Total the expenses by category.

Bank Reconciliation

- Perform a bank reconciliation of each bank account. A bank reconciliation involves comparing the account balance given by the bank with that of your records (Checking Account Register) and explaining or resolving any discrepancy. A discrepancy may simply be due to a difference in timing between the bank’s records and your own, but if errors are found, they should be corrected so that your records and the bank’s are in sync. The worksheet below can be used to reconcile your bank account.

- Enter the Bank Statement Date in field A.1.

- Enter the ending Bank Statement Balance in field A.2.

- Enter Deposits in Transit in section B. (Deposits in Transit are any deposits listed in your check register that have not been posted to the bank statement.)

- Calculate and enter the Total Deposits in Transit in field B.1.

- Enter Outstanding Checks in section C. (Outstanding Checks are any checks that you’ve written that have not been posted to the bank statement.)

- Calculate and enter the Total Outstanding Checks in field C.1.

- Enter the Calculated Account Balance in field D.1. This is computed as shown below:

A.2 Bank Statement Balance

+ B.1 Total Deposits in Transit

– C.1 Total Outstanding Checks

= D.1 Calculated Book Balance

- Enter the Ending Check Register Date for the period shown on the bank statement in field E.1.

- Enter the Check Register Balance as of the Ending Check Register Date in field E.2. (This is the balance in your check register as of the date in E.1.)

- Calculate the Variance (F.1) between the Calculated Account Balance (D.1) and the Check Register Balance (E.2). This calculation is shown below:

D.1 Calculated Account Balance

– E.2 Check Register Balance

= F.1 Variance

- The Variance (F.1) should be zero (0). If the Variance is not 0, review your Check Register and Bank Statement to identify discrepancies. Repeat the bank reconciliation until the Variance (F.1) is equal to 0.

Transfer Annual Income Summary

- Transfer the total dollar amount of the sales for the month, per crop, to the corresponding crop/month on the Annual Income Summary.

- Transfer the total dollar amount of the expenses for the month, per expense category, to the corresponding category/month of the Annual Expense Summary.

Annual activities

At the end of your fiscal (tax) year:

- In the Annual Income Summary, total the monthly dollar amounts for each crop and total the dollar amounts for the crops for each month.

- In the Annual Expense Summary, total the monthly dollar amounts for each category and total the dollar amounts for the categories for each month.

Using your records for your taxes

Report your farm income on Schedule F (IRS Form 1040). Use this schedule to calculate the net profit or loss from regular farming operations.

- Income from farming is reported on Part I of Schedule F (Form 1040) and includes amounts you receive from cultivating, operating, or managing a farm for gain or profit, either as owner or tenant. Transfer the total from the Annual Income Summary to box 1 of Schedule F, Part I.

- The ordinary and necessary costs of operating a farm for profit are deductible business expenses. Part II of Schedule F lists expenses common to farming operations. Transfer the annual total for each expense category from the Annual Expense Summary to the corresponding expense category of Schedule F, Part II.

How long should you keep records?

- You must keep your records as long as they may be needed for the administration of any provision of the Internal Revenue Code. Generally, you must keep records that support an item of income or deduction for at least 3 years from when your tax return was due or filed or within 2 years of the date the tax was paid, whichever is later.

- If you have employees, you must keep all employment tax records for at least 4 years after the date the tax becomes due or is paid, whichever is later.

- Keep records relating to property until the period of limitations expires for the year in which you dispose of the property in a taxable disposition. You must keep these records to figure any depreciation, amortization, or depletion deduction and to figure out your basis for computing gain or (loss) when you sell or otherwise dispose of the property.

- When your records are no longer needed for tax purposes, do not discard them until you check to see if you have to keep them longer for other purposes. For example, your insurance company or creditors may require you to keep them longer than the IRS does.

Next steps and resources

- Purchase the record-keeping tools mentioned in this article.

- Develop your own record-keeping forms based on the examples in this article, or obtain electronic copies of the forms by contacting one of the following:

Farm Services Agency – https://www.fsa.usda.gov/state-offices/Hawaii/index

Oahu Resource Conservation and Development – http://www.oahurcd.org/

GoFarm Hawaiʻi Agbusiness Program – AgBusiness Services

- If you are using, or are planning to use, a tax professional for assistance in preparing your tax return, ask them for input on how they would like you to keep records for tax filing purposes.

- Definitions of deductible and non-deductible expenses on Schedule F can be found on the IRS web site (irs.gov) in Publication 225 – Farmer’s Tax Guide.